- Personal Loans

- Housing Loans

- Vehicle Loans / Leasings

- Propositions

- Savings & Current Accounts

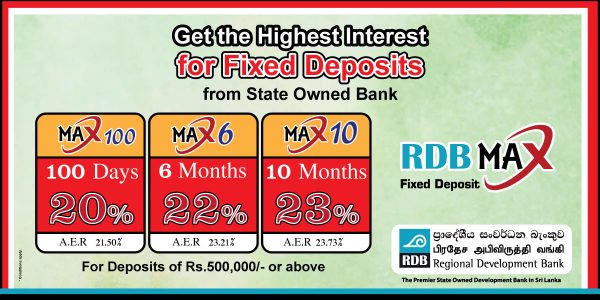

- Fixed Deposits

- Bank Advertisements

Loans

Investment

News

No results found

We couldnt find any result based on your search

Consumption Loans

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 15.00% | Up to 10 Years | LKR 5,000,000 |

|---|

RDB Detusavi Loan (Pensioner Loan)

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 15.00% | Up to 10 Years | Contact Bank |

|---|

Features

Pensioner Loan.

Consumption purpose.

Loan Amount depends on the pension salary.

Maximum repayment period 10 Years

Ran Piyasa

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 17.00% | Up to 10 Years | LKR 5,000,000 |

|---|

Features

RDB offers special housing loan schemes for the lower income sectors at attractive interest rates.

These loans are granted with repayment periods up to 10 years.

Housing loans are offered for purposes such as outright purchase of a house, to buy a land to build a house, renovations and to add new units to an existing house.

RDB Leasing

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Contact Bank | Up to 7 Years | LKR 5,000,0000 |

|---|

Features

Trust of a Government Bank | Less Paper Work

Flexible and Customized Repayment Terms

Repayment Period up to 7 Years

Competitive interest rate and the lowest monthly rentals

Features

Attractive interest rate for deposits and a special loan scheme customized for the target segment.

Minimum Deposit is LKR 500/-

Features

Earn a higher rate of interest than normal fixed deposits.

You can open Fixed Deposits for 100 Day , 06 Months , 10 Months or 01 Year.

For Deposits of Rs. 500,000/- or above .

RDB Kekulu

| Category | Indicative Rate (P.A) |

| Children Savings | Contact Bank |

|---|

Features

The highest returns on savings is provided to encourage schoolchildren and minors to save. Moreover, RDB established school savings units to motivate children to practice saving.

The account is designed to achieve additional objectives

i.e., assisting children’s education as well as helping them to become good citizens. RDB offers a new savings till for every new account as an attraction.

Furthermore, educational seminars are arranged for the account holders who sit for the above examination.

14 plus

| Category | Indicative Rate (P.A) |

| Teen / Youth Savings | Contact Bank |

|---|

Features

RDB 14+ Account, recently introduced by RDB Bank to make the young community bese towards savings habit can be named as a special savings tool.

RDB 14+ is operated with value additions that could attract the teens of 14 and above.

A higher interest rate with the addition of 30% bonus interest compared to the growth of the balance in the Account is offered by RDB 14+ Account.

Loan facilities may be obtained by the young community to fulfill their dreams of owning a house, vehicle, furniture, business, buying electronic equipment and accessories, for educational needs, for foreign tours and that can be arranged through this account.

Account holders are entitled to special benefits at the time of demise of the mother or father or at the time of any sickness of the children.

RDB Liya Saviya

| Category | Indicative Rate (P.A) |

| Women's Saving | Contact Bank |

|---|

Features

Bank provides consultancy services for women who contribute to the country’s economy through self-employment.

Bank is organising The Best Women Entrepreneur Islandwide Competition and RDB Liya saviya account holders are entitled to enroll in this competition.

Bank provides consultancy services for women who contribute to the country’s economy through self-employment.

national level workshops are conducted every year for women entrepreneurs, parallel to International Women’s Day.

RDB New Life – Retirement Plan

| Category | Indicative Rate (P.A) |

| Senior Citizens | Contact Bank |

|---|

Features

Customers can open the account and send deposits monthly every three months or bi-annually.

Benefits can be obtained once he or she completes the age of 55. This can be extended till the age of 60.

RDB Dorin Dora

| Category | Indicative Rate (P.A) |

| Special Savings | Contact Bank |

|---|

Features

It saves the inconvenience of having to come to the branch several times for banking transactions.

The Dorin Dora service is not only limited to collecting deposits, but has also helped the target clientele to obtain loans for development purposes, service the loan account and pay the installments and interest promptly at their convenience.

In addition, utility bill payments can be settled through this service.

This unique service has helped many small-scale entrepreneurs and individuals to build-up healthy account balances over periods of time without much effort and hassle.

In addition, these transactions are carried out via electronic portable hand held devices and the transaction is automatically updated to the Bank’s system.

Features

Special loan facilities under “RDB Detusavi” credit scheme

No service charges for utility bill payments, Special medical scheme

RDB Victory

| Category | Indicative Rate (P.A) |

| Special Savings | Contact Bank |

|---|

Features

higher interest can be obtained while making withdrawals.

As a special benefit a bonus interest of 70% is offered through this account.

All transactions are intimated by SMS messages.

RDB Ayojana (Investment account)

| Category | Indicative Rate (P.A) |

| Special Savings | Contact Bank |

|---|

Features

This is the general investment account introduced by the Bank for the clients who receive credit facilities.

The special features of the product include an attractive interest rate for deposits and a special loan scheme customized for the target segment.

Minimum Deposit is LKR 500/-

RDB Fixed Deposits

| 1 Month | 2 Months | 3 Months |

| 6.50% | 6.50% | 7.00% |

|---|---|---|

| 6 Months | 12 Months (1Y) | 24 Months (2Y) |

| 7.25% | 7.75% | 8.00% |

Features

RDB fixed deposits are identified as a popular mode of investments among its individual and corporate customers.

FDs are available at RDB for periods of 1, 2, 3 and 6 months as well as 1-5 years.

Since the inception, the Bank was able to provide very attractive interest rates compared to other banks.

Special interest rates are offered for fixed deposits with maturity periods of 1 year and above.

RDB – Jaya Nidhana Certificates

| 1 Month | 2 Months | 3 Months |

| Contact Bank | -- | -- |

|---|---|---|

| 6 Months | 12 Months (1Y) | 24 Months (2Y) |

| -- | -- | -- |

Features

This is a certificate which gives the face values amounting to LKR 5,000.00, LKR 10,000.00, LKR 25,000.00, LKR 100,000.00, LKR 500,000.00, LKR 1,000,000.00.

Mainly this product aims to enhance the fixed deposit portfolio of the Bank to provide a helping hand to specially develop the small scale entrepreneurs in the country.

A special feature of this product is that customers can deposit their money at discounted value in terms of face value (future value) after maturity.

No results found

We couldnt find any result based on your search

No results found

We couldnt find any result based on your search

පුද්ගල ණය (Personal Loans) සඳහා ඇති පොළිය දැන් තවත් අඩු කරා!

'RDB වෙසක් සිරිය' චිත්ර නිර්මාණ තරගාවලිය - 2024

No results found

We couldnt find any result based on your search